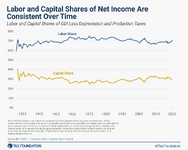

Labor share of GDP is 69%, so capital gets 31% share. If everyone got a 45% pay raise then capital share would be 0.

If there was no capital then labor would get something like $500/year (the approximate amount produced per capita in counties with almost no capital investment).

What is the appropriate share for capital given that the current level makes labor something like 150 times more productive, and labor gets something like 100x higher wages compared to not having access to that capital?

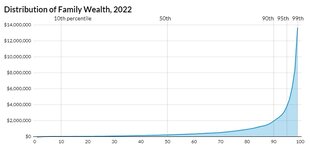

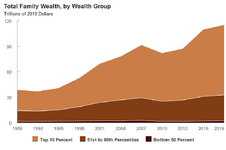

GDP doesn't fully measure wealth. My concern is not productivity, it's wealth distribution. Productivity has risen greatly yet wages have stagnated for the lower and middle classes.

In my opinion, BOTH sides of this argument have merit.

What is often overlooked, I think, is the largish share taken by

highly-paid labor rather than "capital." Wall Street traders and fund managers are my go-to example of highly-paid labor, but lawyers, criminals, dentists (and perhaps dockworkers!) are among several other examples. (Top executives are highly paid but their role is more of capitalist symbiont than "labor.")

Labor pricing in the U.S. spans several orders of magnitude:

* $30/day -- cheapest labor, or disabled

* $300/day -- middle income

* $3000/day -- upper middle income

* $30,000/day -- today's upper income

That final group, earning one THOUSAND times the minimum, are very well off yet STILL are not in the stratosphere where America's thousands of billionaires and near-billionaires partake.

Income and wealth inequality are already major problems, and continues to rise. Yet civilization is faced with unrelated problems of even higher priority. Interesting times.

If the workers in a company town all chose to join and remain in the company, rather than beg in the street, would you take that as a sign that the employer inspires loyalty? No? Then why the bejesus would you assume that everyone joining a union means the union inspires loyalty? Where the workers all chose to join and remain in the union, it's usually because the union negotiated a contract barring the employer from employing non-union workers. Loyalty doesn't enter into it.

If the workers in a company town all chose to join and remain in the company, rather than beg in the street, would you take that as a sign that the employer inspires loyalty? No? Then why the bejesus would you assume that everyone joining a union means the union inspires loyalty? Where the workers all chose to join and remain in the union, it's usually because the union negotiated a contract barring the employer from employing non-union workers. Loyalty doesn't enter into it.